Turf account is the term used to describe someone or a company who accepts bets and pays them out on sporting events. It can also be used to describe a bookmaker, bookie, or turf account.

A person who profits by taking bets on a race and forcing the winners to pay afterward.

Person who works in betting shops and accepts bets on sporting events such a horse race or football match.

bookie, or a slang term for a bookmaker in England and other parts of the United Kingdom.

Since the early 1990s, the term "bookie" has been used as slang to describe someone who bets on sporting events or other events like a political elections. This is a popular slang phrase in Britain.

In the United States the word "bookie" is used to refer to a bookmaker. Bookmakers accept a wide range of wagers, including those on professional sports and horse racing.

In the United States a turf accounting salary average is $4.053,295. The average salary for a turf accountant in the United States is $4,053,295.

A turf accountant may work for a public or private organization such as a city or county government or a private company that manages golf courses or sports fields. They need to have knowledge in many different areas of turf management. These include lawn maintenance as well as plant biology and weeding.

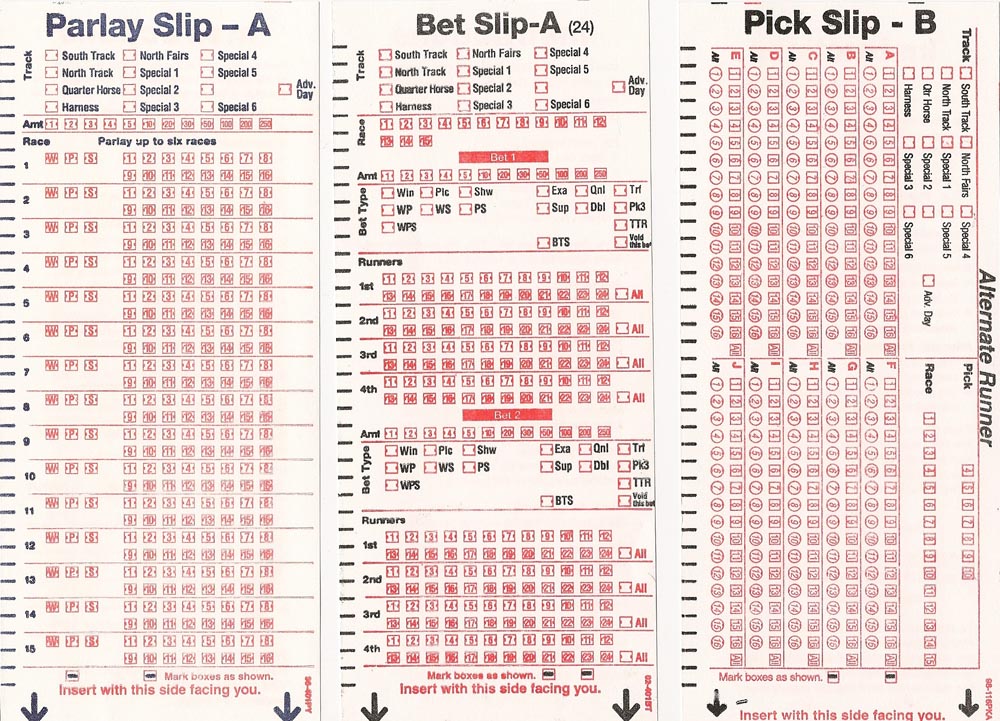

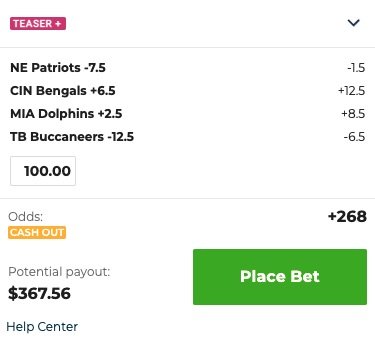

Online gambling in the entertainment industry is growing fast. Apps that allow users to play casino games or bet on horse racing from their mobile devices are among the most important developments in this sector.

A person that accepts bets for sporting or political outcomes at agreed odds.

FAQ

How much debt can you take on?

It is essential to remember that money is not unlimited. Spending more than what you earn can lead to cash running out. This is because savings takes time to grow. If you are running out of funds, cut back on your spending.

But how much should you live with? While there is no one right answer, the general rule of thumb is to live within 10% your income. That way, you won't go broke even after years of saving.

This means that, if you have $10,000 in a year, you shouldn’t spend more monthly than $1,000. You should not spend more than $2,000 a month if you have $20,000 in annual income. For $50,000 you can spend no more than $5,000 each month.

It's important to pay off any debts as soon and as quickly as you can. This includes student loans, credit cards, car payments, and student loans. When these are paid off you'll have money left to save.

It is best to consider whether or not you wish to invest any excess income. You may lose your money if the stock markets fall. But if you choose to put it into a savings account, you can expect interest to compound over time.

Let's suppose, for instance, that you put aside $100 every week to save. Over five years, that would add up to $500. Over six years, that would amount to $1,000. In eight years, your savings would be close to $3,000 In ten years you would have $13,000 in savings.

Your savings account will be nearly $40,000 by the end 15 years. That's quite impressive. If you had made the same investment in the stock markets during the same time, you would have earned interest. Instead of $40,000, your net worth would be more than $57,000.

This is why it is so important to understand how to properly manage your finances. If you don't do this, you may end up spending far more than you originally planned.

What is the easiest passive source of income?

There are many different ways to make online money. However, most of these require more effort and time than you might think. So how do you create an easy way for yourself to earn extra cash?

The solution is to find what you enjoy, blogging, writing or selling. It is possible to make money from your passion.

For example, let's say you enjoy creating blog posts. Make a blog and share information on subjects that are relevant to your niche. Then, when readers click on links within those articles, sign them up for emails or follow you on social media sites.

This is called affiliate marketing, and there are plenty of resources to help you get started. For example, here's a list of 101 Affiliate Marketing Tools, Tips & Resources.

You could also consider starting a blog as another form of passive income. This time, you'll need a topic to teach about. After you've created your website, you can start offering ebooks and courses to make money.

There are many online ways to make money, but the easiest are often the best. Make sure you focus your efforts on creating useful websites and blogs if you truly want to make a living online.

Once you've built your website, promote it through social media sites like Facebook, Twitter, LinkedIn, Pinterest, Instagram, YouTube and more. This is called content marketing, and it's a great method to drive traffic to your website.

What is the difference in passive income and active income?

Passive income refers to making money while not working. Active income requires effort and hard work.

You create value for another person and earn active income. If you provide a service or product that someone is interested in, you can earn money. For example, selling products online, writing an ebook, creating a website, advertising your business, etc.

Passive income is great because it allows you to focus on more important things while still making money. However, most people don't like working for themselves. Instead, they decide to focus their energy and time on passive income.

The problem is that passive income doesn't last forever. If you are not quick enough to start generating passive income you could run out.

Also, you could burn out if passive income is not generated in a timely manner. So it's best to start now. If you wait to start earning passive income, you might miss out opportunities to maximize the potential of your earnings.

There are three types to passive income streams.

-

There are many options for businesses: You can own a franchise, start a blog, become a freelancer or rent out real estate.

-

These investments include stocks and bonds as well as mutual funds and ETFs.

-

Real estate - This includes buying and flipping homes, renting properties, and investing in commercial real property.

Why is personal finance so important?

If you want to be successful, personal financial management is a must-have skill. We live in a world with tight finances and must make tough decisions about how we spend our hard earned cash.

Why then do we keep putting off saving money. What is the best thing to do with our time and energy?

The answer is yes and no. Yes, most people feel guilty saving money. You can't, as the more money that you earn, you have more investment opportunities.

As long as you keep yourself focused on the bigger picture, you'll always be able to justify spending your money wisely.

It is important to learn how to control your emotions if you want to become financially successful. When you focus on the negative aspects of your situation, you won't have any positive thoughts to support you.

Your expectations regarding how much money you'll eventually accumulate may be unrealistic. This is because you haven't learned how to manage your finances properly.

These skills will prepare you for the next step: budgeting.

Budgeting is the act or practice of setting aside money each month to pay for future expenses. Planning will allow you to avoid buying unnecessary items and provide sufficient funds to pay your bills.

You now have the knowledge to efficiently allocate your resources and can start to see a brighter financial future.

What are the most profitable side hustles in 2022?

The best way today to make money is to create value in the lives of others. You will make money if you do this well.

Although you may not be aware of it, you have been creating value from day one. You sucked your mommy’s breast milk as a baby and she gave life to you. When you learned how to walk, you gave yourself a better place to live.

If you keep giving value to others, you will continue making more. The truth is that the more you give, you will receive more.

Everybody uses value creation every single day, without realizing it. Whether you're cooking dinner for your family, driving your kids to school, taking out the trash, or simply paying the bills, you're constantly creating value.

There are actually nearly 7 billion people living on Earth today. Each person is creating an amazing amount of value every day. Even if you only create $1 worth of value per hour, you'd be creating $7 million dollars a year.

This means that you would earn $700,000.000 more a year if you could find ten different ways to add $100 each week to someone's lives. You would earn far more than you are currently earning working full-time.

Now, let's say you wanted to double that number. Let's assume you discovered 20 ways to make $200 more per month for someone. You'd not only earn an additional $14.4 million annually but also be incredibly rich.

Every single day, there are millions more opportunities to create value. Selling products, services and ideas is one example.

Although we tend to spend a lot of time focusing on our careers and income streams, they are just tools that allow us to achieve our goals. The ultimate goal is to assist others in achieving theirs.

To get ahead, you must create value. You can start by using my free guide: How To Create Value And Get Paid For It.

How do wealthy people earn passive income through investing?

If you're trying to create money online, there are two ways to go about it. The first is to create great products or services that people love and will pay for. This is known as "earning" money.

The second way is to find a way to provide value to others without spending time creating products. This is called "passive" income.

Let's say that you own an app business. Your job is to develop apps. You decide to make them available for free, instead of selling them to users. It's a great model, as it doesn't depend on users paying. Instead, advertising revenue is your only source of income.

Customers may be charged monthly fees in order to sustain your business while you are building it.

This is the way that most internet entrepreneurs are able to make a living. They give value to others rather than making stuff.

Statistics

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

External Links

How To

How to Make Money online

How to make money online today differs greatly from how people made money 10 years ago. How you invest your funds is changing as well. There are many ways that you can make passive income. But, they all require a large initial investment. Some methods are more difficult than others. You should be aware of these things if you are serious about making money online.

-

Find out which type of investor you are. PTC sites, which allow you to earn money by clicking on ads, might appeal to you if you are looking for quick cash. If you're looking for long-term earning potential, affiliate marketing might be a good option.

-

Do your research. Before you make a commitment to any program, do your research. Read through reviews, testimonials, and past performance records. You don't want to waste your time and energy only to realize that the product doesn't work.

-

Start small. Do not rush to tackle a huge project. Start small and build something first. This will enable you to get the basics down and make a decision about whether or not this type of business is for your. When you feel confident, expand your efforts and take on bigger projects.

-

Get started now! It's never too late to start making money online. Even if you've been working full-time for years, you still have plenty of time left to build a solid portfolio of profitable niche websites. All you need to get started is an idea and some hard work. Get started today and get involved!